Investing Fundamentals: Index Funds

In this series of posts, I will do my best to introduce the concepts related to investing in the stock market in a step-by-step process from the perspective of someone learning about these things for the first time.

In this very first post I want to give someone who is not at all invested into any stocks a step-by-step guide on what to do before they decide to read any further into this series of posts.

Why Should I Invest?

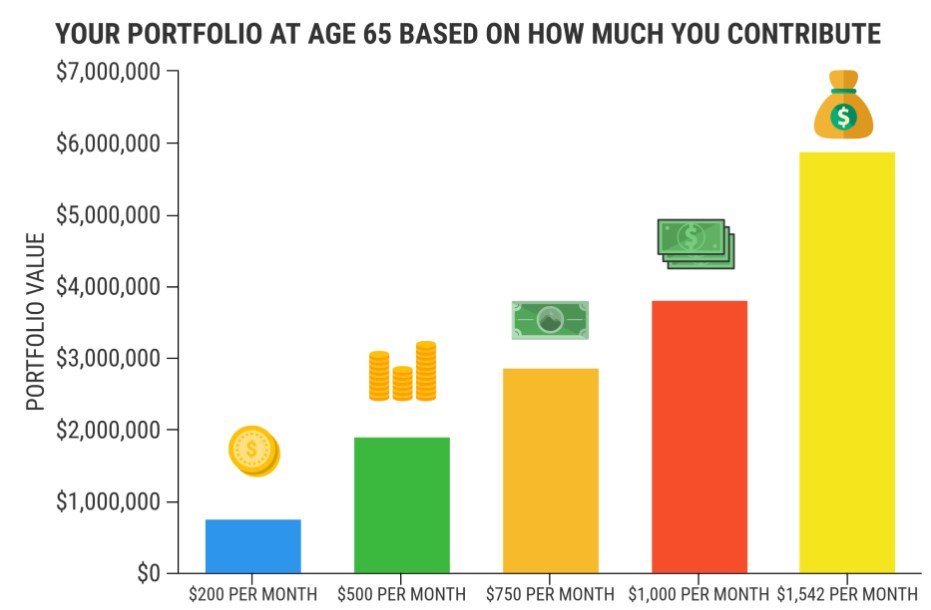

I am not going to go into a long explanation of why. Just look at this graph and you should understand why and why you should do so right away. This is a graph from U.S. News and I will include the link at the bottom of the graph so you can look at 8 other graphs that should convince you to follow the steps outlined in this post.

Investing in an Index Fund...

What is an index fund? Why should I invest in an index fund? Why should I take this shmucks advice? Don’t take my advice take the advice of the god of investing Warren Buffet. He told CNBC in 2017 “Consistently buy an S&P 500 low-cost index fund. I think it’s the thing that makes the most sense practically all of the time.” Whether it’s Warren Buffet or a country club member that told me the same thing while I was caddying the advice they’d give to almost anyone is to invest in an index fund. Now that you understand I’m not a shmuck let me tell you what exactly an index fund is. For the purposes of this simple introduction on stocks, my definition will basically tell you what the S&P 500 is which is one example of an index fund so you get an idea of what you will be putting your money in too at the end of this post.

My Simple Definition of an Index Fund: The S&P 500 is essentially a compilation of the 500 leading U.S. publicly traded stocks. It is seen as a good investment because of its diversity and consistent 7-8% return over time.

Official Definition of an Index Fund: An “index fund” is a type of mutual fund or exchange-traded fund that seeks to track the returns of a market index. Yeah at the time of me writing this I don’t even know what that really means either.

Step 1: Open a Brokerage Account

Short Answer: Vanguard or Fidelity

There are many brokerage firms you can open a brokerage account with such Charles Schwab, E-Trade, Webull, Ally Invest to name a few and it does and doesn’t really matter where you open the account because of slight pros and cons associated with each account. My personal recommendations are Fidelity and Robinhood because of their ease of use which is suitable for beginners. Once you become more advanced you may find that other accounts have particular benefits you are looking for but this does not matter right now. As you learn more you will grow as an investor but for now, the purpose of the post is for you to start investing your first 15% by your next paycheck. I have linked the signup instructions to Fidelity HERE.

Step 2: How much should you invest?

Short Answer: 15% of total income.

What experts seem to agree on after looking at thousands and thousands of budgets is that you should be investing a minimum of 15% of your household income. Now, this will really depend on your circumstance and I won’t be going in to why you should invest less or more in this post because I just want everyone develop the habit of putting aside money to invest in stocks. But to say something related me as a student living with my parents and not having to pay a ridiculous amount for school at UIC, this number will probably be a little higher. If you would like to learn about a concept that involves investing/saving up to 75% of your income by the acronym FIRE (Financial Independence, Retire Early) click HERE.

Step 3: Forming a habit

Starting now versus later…

You are not going to become a millionaire overnight doing this. If you want to do that you can go ahead and lose all your money day trading. It’s about forming a habit. It’s about having the discipline and knowledge to put away money to invest in order for it to grow over time. I recently came across a website I have linked here. I found out that the same thing you could buy for $100 in 2018 now costs $117. 2018 has only been 4 years ago which should make you realize you lose money if you just let it sit in your bank account. The SMP 500 has an average annual return rate of around 10% a year. Investing is a way to beat the 3.8% increase in inflation each year. I hope you understand that you are losing your money the longer you go without investing. Please do at the end of this article. For the final step I will show you exactly what to do to purchase your first share or fraction of one.

Step 4: Purchasing a Share

Definition: A share is a portion of ownership or ‘equity’ in a company. Shares are also sometimes referred to as stocks.

Once you set up your account you will then need to connect a bank account to wire some money into your new brokerage account. You will then use the search to type in VOO. This will take you to the Vanguard S&P 500. You will then put 15% of your paycheck into the fund. That’s it. Now repeat this every paycheck and do more research now that you are officially an investor. I will continue posting about things like retirement accounts, what is a safe vs risky investment and much more so if you would like to learn more check into my blog weekly.